Transferring a 403(b) contract with an outside vendor to your account with Sentinel Benefits is as easy as 1, 2, 3.

A 403(b) contract transfer is different from a rollover between retirement accounts. A rollover is a movement of one retirement account or IRA into a different entity's retirement plan. A contract transfer allows you to consolidate accounts with multiple vendors that are at the same Employer. For example, your are a participant in the ABC 403(b) plan and you currently hold part of your account balance at Sentinel and the other part at a a different custodian. A contract transfer allows you move the proceeds from that outside custodian into your account at Sentinel. This allows for your balance to be managed under one account.

The below process is to achieve this transfer.

To consolidate your 403(b) assets with your employer into your Sentinel account, log into your online account to begin the process.

Step 1: Complete the online contract transfer form

To initiate your contract transfer request online, follow the below steps within your account:

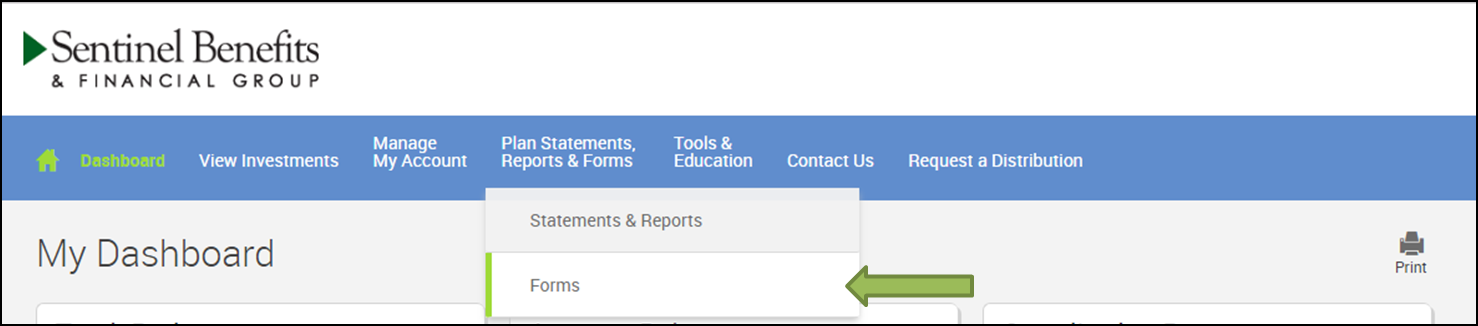

- Access the form by selecting Plan Statements & Forms and then selecting Forms from the menu.

- Select the Contract Transfer Form from the "Select Form" pick list.

- Next, click Get Results

- Once your Form generates, click BEGIN HERE to start your online request.

- No Form? If you do not yet have any funds in your plan the form will not generate. Please either Contact Us to get a manual copy, or wait until your first payroll deposit to generate the online form.

The online form will require you to confirm the transaction being processed is for a contract transfer. Once submitted, the below e-mail will be sent to the address provided. This e-mail will include the following:

- A .pdf transfer form to complete and provide to your employer for signature

- A Qualified Plan Letter, if needed, to begin your request with your prior vendor. Some retirement plan providers require a qualified plan letter to confirm that your rollover request is being sent to a plan (at Sentinel) that can accept the qualified assets. If no additional documentation is required by your former account's custodian, you may disregard it.

Step 2: Request a check from your current provider

Once your transfer is approved by your employer, you can proceed to notifying the outside contract's vendor of the request. Please provide the institution issuing the check the specific payment instructions and account number noted on the previously completed form. Note a Contract Transfer is a non-taxable distribution. Once deposited into your account at Sentinel, the proceeds will invested to the same investment elections you currently have on file with us and within the applicable sources noted on your form.